Business Use Of Home Depreciation Rate

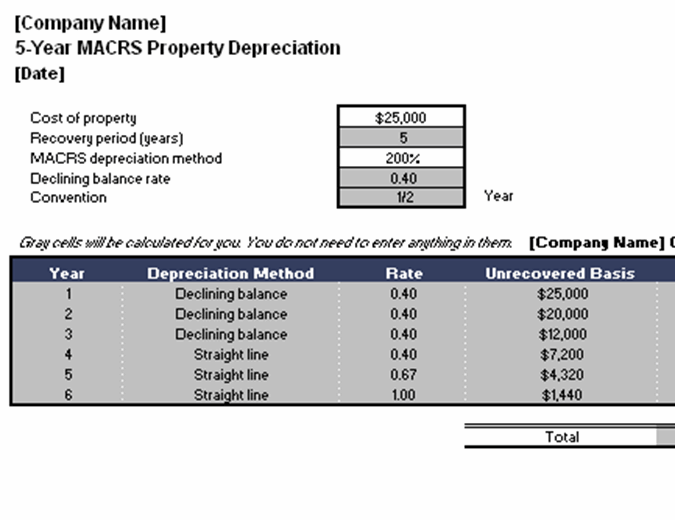

The percentage of bonus depreciation phases down in 2023 to 80 2024 to 60 2025 to 40 and 2026 to 20. The new rules allow for 100 bonus expensing of assets that are new or used.

Accumulated Depreciation How It Works And What You Need To Know

Appropriately titled the Simplified Option it works out to 5 per square foot of the business or office space in your home.

Business use of home depreciation rate. Mortgage interest real estate taxes. The business expects that it will use the furniture for 10 years. How to figure depreciation Here comes the tricky part.

Standard deduction of 5 per square foot of home used for business maximum 300 square feet. Multiply the cost of the improvement by the business-use percentage and depreciate the result over the recovery period that would apply to your home if you began using it for business at the same time as the improvement. At a corporate tax rate of 35 youd save 8750 on taxes.

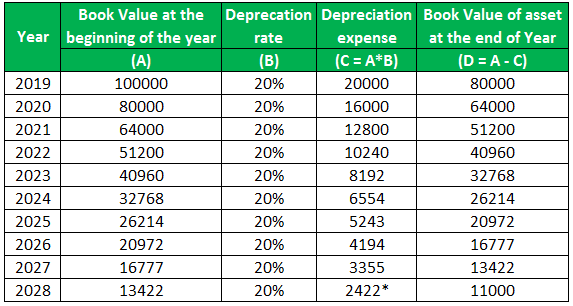

If the taxpayer is depreciating assets in addition to the home itself enter the home on Form 4562 rather than Part III of Form 8829. The depreciation rate is the percentage rate at which asset is depreciated across the estimated productive life of the asset. The key difference from normal straight line depreciation is that a mid month convention is used in calculating depreciation in the first and last years.

Telephone costs If you run your business from home you can claim a deduction of 50 of the rental of a telephone landline if this is also your private line. For the percentage to use for the first year see Table 2. 381990 x 10 38199.

The depreciation rate on the laptop will be calculated over 3 years. Allowable home-related itemized deductions claimed in full on Schedule A. You can claim depreciation on capital items such as a computer office furniture and fittings used for business purposes in your home.

It might save you a lot of tedious record keeping if your work space is smaller than this but otherwise you might be limiting your deduction to less than it could be. To calculate use this formula. For more information on recovery periods see Pub.

Depreciation Rate for Furniture and Office Equipment. The house depreciation rate will depend largely on the system you intend to use as there are two primary ways to calculate your own deprecation. Record the annual depreciation.

Figuring out how much of a depreciation deduction you can take on your assets. The depreciable amount of an asset is the cost of an asset or other amount substituted for cost less its residual value. For every year thereafter youll depreciate at a rate of 3636 or 359964 as long as the rental is in service.

A different Depreciation percentage than the 2564 used in the example would override this and produce a different result. Starting net book value x Depreciation rate. Use the double-declining balance depreciation rate which is double that of the straight-line depreciation rate.

Unfortunately it caps out at 300 square feet. In this case count the number of months or partial months you used your home for business. Multiply the cost of the improvement by the business-use percentage and depreciate the result over the recovery period that would apply to your home if you began using it for business at the same time as the improvement.

A business fits out a new office buying various pieces of furniture and office equipment. The depreciation rate will be calculated over 10 years. 3636 each year as long as you continue to depreciate the property according to Investopedia.

For improvements made this year the recovery period is 39 years. That is only 12 month of depreciation is calculated for the months the property was put into or taken out of service. For the first year youll depreciate 1667 or 165033 99000 x 1667.

These assets had to be purchased new not used. The old rules of 50 bonus depreciation still apply for qualified assets acquired before September 28 2017. Her business percentage works out to 10 1201200 10.

Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. The costs of improvements made after you begin using your home for business that affect the business part of your home such as a new roof are depreciated separately. Use a prorated depreciation percentage if you stopped using your home for business during the year.

If you depreciate your asset using the General Depreciation System which lasts 275 years you would depreciate an equal amount. 1 SCHEDULE II 2 See section 123 USEFUL LIVES TO COMPUTE DEPRECIATION. It is different for each class of assets.

So her depreciation deduction for her home office in 2016 would be. Your deduction of otherwise nondeductible expenses such as insurance utilities and depreciation of your home with depreciation of your home taken last that are allocable to the business is limited to the gross income from the business use of your home minus the sum of the following. Repeat until the book value falls to the salvage.

Next year and all the years she uses this home office the total depreciation would equal 538462 21000039 years. Depreciation under Companies Act 2013. It may also be defined as the percentage of a long term investment done in an asset by a company which company claims as tax-deductible expense across the useful life of the asset.

Depreciation Rates As Per I T Act For Most Commonly Used Assets Taxadda

Excel Db Function Double Entry Bookkeeping

4 Ways To Calculate Depreciation On Fixed Assets Wikihow

Straight Line Depreciation Template Download Free Excel Template

Straight Line Depreciation Double Entry Bookkeeping

Ato Depreciation Atotaxrates Info

A Guide To Property Depreciation And How Much You Can Save

Ato Depreciation Atotaxrates Info

Depreciation Rate Formula Examples How To Calculate

Depreciation Rate Formula Examples How To Calculate

Depreciation Rate Formula Examples How To Calculate

Definitions Depreciation In Fixed Assets The Monetary Value Starts To Decreases Over Time Due To Use Wear And T Fixed Asset Marketing Trends Explained

Calculate Depreciation In Excel With Sln Straight Line Method By Learnin Learning Centers Excel Tutorials Excel

Prime Cost Straight Line And Diminishing Value Methods Australian Taxation Office

Depreciation Formula Calculate Depreciation Expense

4 Ways To Calculate Depreciation On Fixed Assets Wikihow

Depreciation Formula Examples With Excel Template

Reducing Balance Depreciation Calculation Double Entry Bookkeeping

Post a Comment for "Business Use Of Home Depreciation Rate"